s corp tax rate calculator

LLC Taxes Discover your LLCs total taxes effective rate and potential savings. However if you elect to.

Llc Taxes Payroll Taxes Llc Taxes Payroll

S corporation the S corporation should provide your proportionate share of the S corporations depreciation deduction.

. Piscataway is located within Middlesex County. If you are a nonresident or part-year resident you must complete Form. As we explain below you may be able to reduce your tax bills by creating an S corporation for your business.

Estimated Local Business tax. Being Taxed as an S-Corp Versus LLC. S Corps S Corp guides resources and calculators for saving taxes.

Total first year cost of S-Corp. The SE tax rate for business owners is 153 tax. This includes the rates on the state county city and special levels.

What is the sales tax rate in Piscataway New Jersey. C-Corp or LLC making 8832 election. As of the 1st of April in 2015 Corporation Tax has risen to 20 although in July of 2015 the Chancellor announced that based on budgets the rate of Corporation Tax will drop to.

Lets look at some numbers to see how this works. For example if you have a. The average cumulative sales tax rate in Piscataway New Jersey is 663.

Most corporations must pay state income tax. Say you earn 150000 in revenue as the owner. Instead you only pay payroll taxes on the salary you earn from your S corp.

S-Corp or LLC making 2553 election. The New Jersey State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 New Jersey State Tax CalculatorWe also. Self Employment Find out.

Tax compliance is a challenge but Avalara can help you simplify the process. Annual state LLC S-Corp registration fees. The minimum combined 2022 sales tax rate for Piscataway New Jersey is.

S Corporation Subchapter S and S Corp Tax Rate. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. Partnership Sole Proprietorship LLC.

Annual cost of administering a payroll. If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax. For example if your one-person S corporation makes 200000 in profit and a.

An S corporation S corp is a tax structure under Subchapter S of the IRS Internal Revenue Service for federal state and. Check each option youd like to calculate for. 44 states have a corporate income tax but South Dakota and Wyoming are the only states that do not have a corporate income.

Ad Use Avalara to help with rate calculation exemption certificates and returns filing. This is the total of state county and city sales tax rates. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

How Is Company Tax Calculated Lawpath

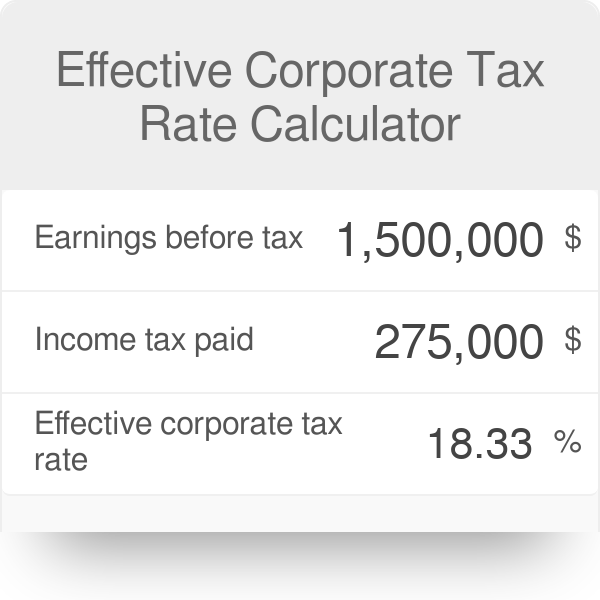

Effective Corporate Tax Rate Calculator

5 Tax Filing Tips For College Students Tax Preparation Tax Lawyer Online Taxes

Effective Tax Rate Formula Calculator Excel Template

Who Hates Taxes The Answer Isn T What You Think Administracion Servicio A Clientes Negocios Internacionales

How To Calculate Income Tax In Excel

Company Tax Rates 2022 Atotaxrates Info

How To Calculate Income Tax In Excel

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Accounting Business Calculator Finance Percentage Tax Icon Download On Iconfinder Accounting Calculator Icon

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Salehaamir322 I Will Provide Swedish Tax Consulting For 60 On Fiverr Com Tax Consulting Consulting Tax

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

Effective Tax Rate Formula And Calculation Example

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps